Gold Demand Trends Q2 2025

Gold

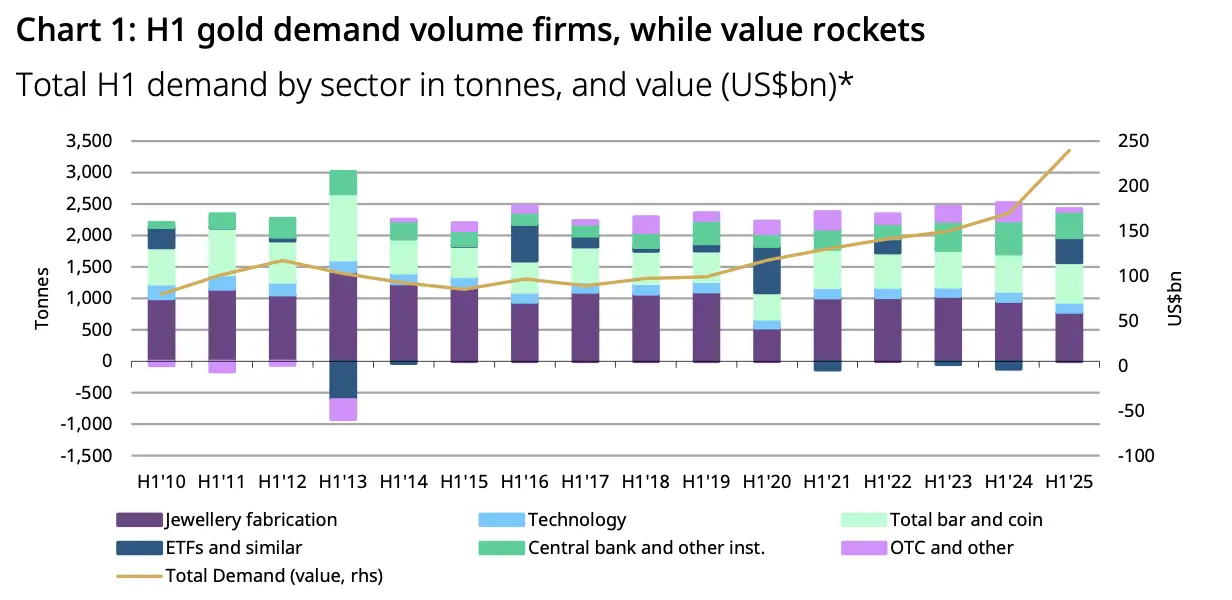

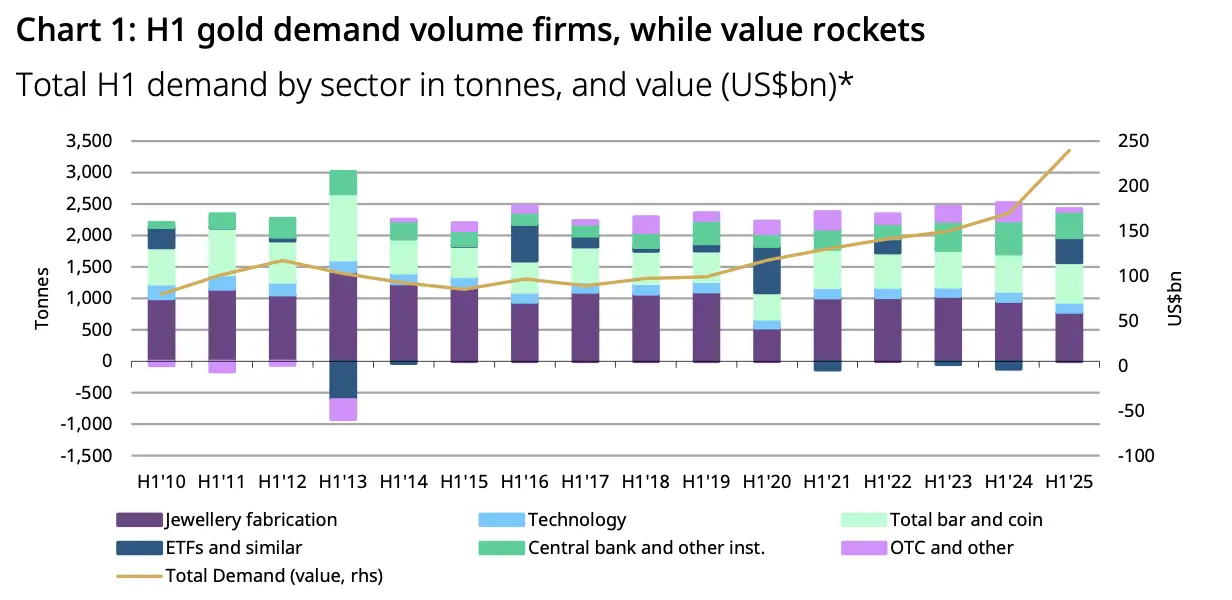

A second consecutive quarter of hefty demand for global gold-backed ETFs was instrumental in boosting overall Q2 demand. Uncertain global trade policy, geopolitical turbulence and the rising gold price all fuelled inflows.

Bar and coin investors also joined the fray, attracted by the rising price and gold’s safe-haven attributes. Two consecutive quarters generated the strongest first half for bar and coin investment since 2013.

Central banks remained a key pillar of global demand, adding 166t to global official gold reserves. Although the pace of buying moderated, the outlook for central bank demand remains healthy.

Jewellery demand volumes and value continued to diverge: y/y declines in tonnage were widespread, while spending on gold jewellery saw universal gains. Volumes were very muted, almost retreating back to 2020 pandemic levels.

Gold used in technology came under pressure from the potential impact of US tariffs, although growing demand for AI-related applications remains an area of strength.

The U.S. Dollar (USD) traded higher on Tuesday, recovering from Monday’s drop as markets absorbed the U.S. Supr...

U.S. equities moved higher Tuesday, driven by strength in Advanced Micro Devices and software stocks, as investor con...

Shares of Advanced Micro Devices (AMD) jumped sharply after announcing a massive multi-year AI agreement with Meta Pl...